Welcome! Let's find the best Medicare Plan for you.

Step 1

Learn

We will help you understand Medicare - what it is - and how it

works. Once you have an

great basic understanding of Medicare we can move to step 2.

To begin the process -

schedule an

appointment with one of our certified and licensed agents:

Step2

Determine the best Medicare Strategy for you!

Here are the options we will discuss with you:

Plan 1

Regular (Standard) Medicare Part A, Part B with a Stand Alone Prescription Drug Plan.

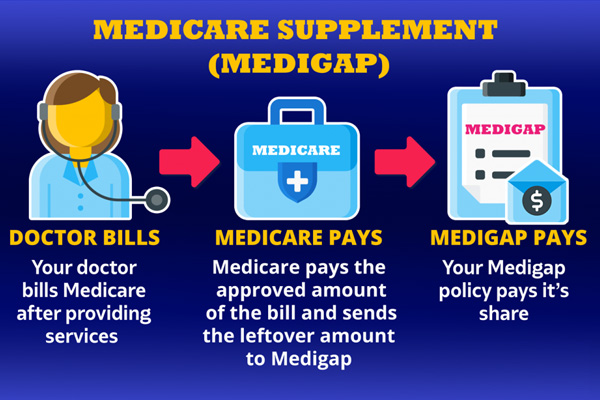

Plan 2

Regular Medicare Part A, Part B with a Stand Alone Prescription Drug Plan and a Medicare Gap or Supplement Policy.

Plan 3

Medicare Part C - A Medicare Advantage Plan (PPO, HMO, or PFFS) Medicare plans run by Insurance Companies that are contracted with CMS

Plan 4

Medicare Part C plans combined with Senior Benefits Supplements.

CAUTION: Do not confuse "Senior Supplement policies with "Medicare Gap" policies. Senior Supplement policies are specifically designed to cover out of pocket expenses not covered by Part C Medicare Advantage Plans.

CAUTION - it is illegal for you to purchase a Medicare Gap Plan while you have a Part C Medicare Advantage Plan, or to enroll in a Part C Medicare Advantage plan if you have an active Medicare Gap plan in place. It is certainly permissible for you to purchase Senior Supplemental policies to enhance your Part C Medicare Advantage Plan.

Plan 5

Dual Eligible Plans - Medicare Advantage Plans for individuals with Chronic Health Conditions - or individuals who qualify for Medicaid (including "extra help") and Medicare.

* We prepare individuals for years prior qualification at age 65 by helping establish Health Savings

Accounts. Once you are 65 you may not contribute to an HSA but may continue to spend the money you have

saved on qualified medical and prescription drug expenses.

** If you are already 65 and are no longer eligible for an HSA, we supplement Medicare Advantage plans

with Senior Supplement products that offset the out of pocket expenses from hospital stays, skilled

nursing and critical illness expenses. Purchasing Senior Supplement Policies is always OPTIONAL.

Determining the best strategy for you will depend on many factors. We can help guide you to your best

strategy. Please schedule an appointment with one of our certified and licensed agents:

Step3

Choose your plan(s.)

Once we have determined how you will approach Medicare and which strategy is best suited for your individual needs, we will help you compare the specific plans in your area to help you determine the right plan for you. You will take into consideration monthly premiums (both Part B premiums and plan premiums) and also out of pocket expenses in all areas (Part A and Part B medical expenses and also Part D prescription drug expenses.)

Contact

To receive further information about specific plans in your area - please provide the following information